Posts by Julie Rachlin

How Technology and Customer-Centricity Are Redefining the Industry, with Mylo President & COO Belen Tokarski

Leading InsurTechs Mylo and Fenris Digital are helping transform the insurance industry using a customer-centric approach to redefine how policies are crafted and delivered, ensuring a future where insurance is more accessible, personalized, and responsive to individual needs.

Read MoreA Look Back at Jay Bourland’s InsurTech NY 2023 Talk

How Fenris Digital is Transforming InsurTech with Accessible, Impactful AI At InsurTech NY 2023, Fenris Digital CTO Jay Bourland delivered a thought-provoking talk on how machine learning and AI are reshaping the insurance industry. (See the video at the end of this post.) Through an engaging story and practical examples, Bourland highlighted Fenris’ unique approach.…

Read MoreHow Driver Record Insight (DRI) Addresses 5 Major Pain Points for Auto Insurance Agencies

Navigating the complexities of auto insurance quoting can be challenging for agencies, especially when it comes to accurately assessing risk and providing competitive quotes. Inaccurate Auto Insurance Quotes Lead to Unhappy Customers and Lower Profitability In the competitive landscape of auto insurance, accurate data and actionable insights are crucial for success. However, inaccurate quoting from…

Read MoreRevolutionizing Commercial Insurance: How Fenris is Changing the Game

Real-time Data and Insight is Changing How Commercial Insurance Risk is Identified and Quoted In the complex world of commercial insurance, agents and brokers often grapple with the daunting task of accurately gathering application data. The average time to close a commercial insurance deal can be up to 12 weeks, with agents going back and…

Read MoreNavigating Commercial Markets: Opportunity or Crisis?

With carriers like Nationwide and Allstate pulling out of large commercial markets and more carriers likely to follow suit, are you ready to seize the opportunity? Why Your Company Needs the Human Element and AI in 2024 According to USI, commercial rates are stabilizing as we head into 2024, and with hundreds of thousands of…

Read MoreFive Ways Fenris Insight Can Help You Grow Your Insurance Business

Acquiring new customers, retaining policyholders, and increasing lifetime customer value are foundational to business growth. This holds true across insurance brokerages, agencies, and carriers — particularly today when it’s easy for cost-sensitive customers to switch providers. Fenris Insight can help you grow your customer base and increase revenues while reducing costs. By integrating our fast,…

Read MoreHow can Insight improve applicant acquisition and reduce cost?

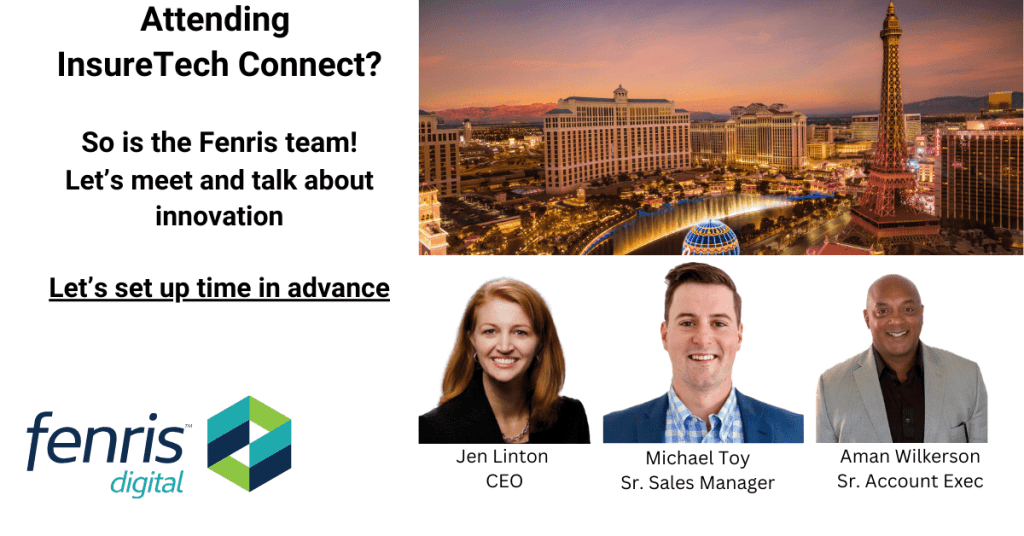

Join Jen Linton, Fenris Digital CEO, as she uncovers how hundreds of companies are boosting their customer acquisition processes 10× with industry-leading data and machine learning models. Demo Stage, November 1 Mandalay Bay, Las Vegas

Read MoreInsureTech Connect 2023

October 31, 2023 – November 2, 2023

Read More