Top 3 Benefits of Form Pre-fill

Have you ever been typing a query into Google search and had it auto populate the rest of your question? Magic? Mindreading? No! That is form prefill and it is being utilized on millions of online forms. Online applications and web stores utilize prefill plugins to make the shoppers/subscribers lives easier. Prefill is everywhere. Prefill is really an API plugin to the website that allows user information to be automatically populated on your form, so that users don’t have to waste time filling in standard details like name, email, or home address. We’ve put together the top three reasons prefill/autofill is beneficial to the insurance quoting process. Read more…

1) Improved Customer Experience

Studies show that up to 86% of users will leave a page immediately when they’re required to fill out a form. Part of the reason for such a high number of abandonment is energy preservation. Simply put, online forms are tedious and users don’t want to spend copious amounts of time filling out forms. Applying for insurance is confusing enough in itself, automating that process for applicants is crucial for conversions. Pre-fill saves users time and tempers. Happier users leads to increased quoting completion and conversion.

2) Increased Quote Completion and Conversions

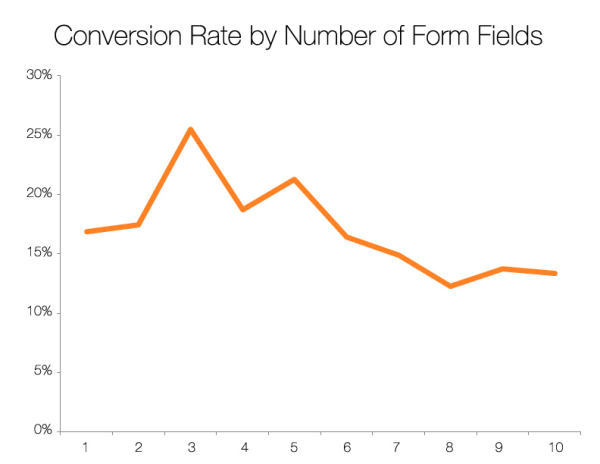

Essentially, pre-fill asks users to do less and when asked to do less, many of us are more likely to complete the task. Utilizing autofill has a significant impact on a form’s completion and conversion rate. This research by Hubspot found that 3 fields is the optimal number on a form to drive completion and conversion.

To that point, using Fenris Digital’s prefill products can increase the likelihood of a user finishing the application by three times.

3) Decreased cost of acquisition

Accuracy is an important part of the insurance quoting and binding process. Prefilled data can improve accuracy. Oftentimes fields necessary for quoting are challenging to enter such as the VIN of your vehicle or a new address for homeowners insurance. Once a customer has to stop and look up information and get back to you, you have lost them. Worse they enter incorrect information because they are trying to type 17 digits on a phone screen and you quote based on incorrect information. By the time the incorrect data is caught, the quote is reissued and the customer is frustrated, you have spent sunk acquisition costs. Furthermore, pre-filled data can be used in split second time to score your leads as they come in to allow you to target customers most likely to convert and steer them to the most appropriate products as you return their quote.

Final Thoughts

Pre-fill tools can add a lot of value to your online forms and help modernize your business. However, they are especially essential in the insurance industry for its ability to improve customer experience, increase quote conversion, and decrease cost of customer acquisition. Interested in learning more about how exactly pre-fill tools can seamlessly integrate and improve your conversion rates? Check out Fenris Digital’s product page here: https://fenrisd.com/products/